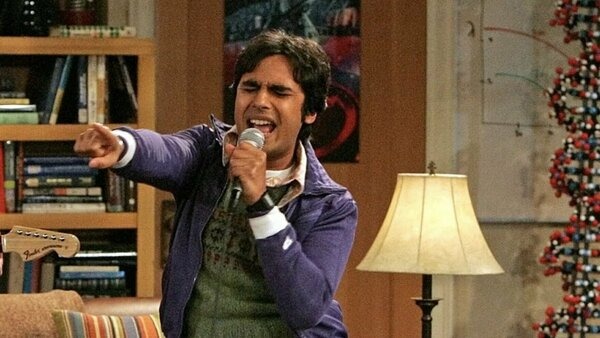

Kunal Nayyar, who rose to fame playing an astrophysics professor in a popular TV comedy, is now following his dream as a fintech entrepreneur for global families

Nearly 40 years have passed since the ‘Big Bang’ in financial markets revolutionised London’s investment industry.

A series of de-regulatory measures introduced by UK prime minister Margaret Thatcher dramatically boosted the City’s and the industry’s international appeal, with US, European and Asian banks soon entering the fray.

The next ‘Big Bang’, believe commentators, will be linked to the digital revolution, with tech firms soon able to compete with banks and asset managers for custom.

One of the promoters of the latest shake-up is Kunal Nayyar, a tech entrepreneur and one of Hollywood’s wealthiest actors, famous for his role as nerdish, socially inept astrophysics professor Raj Koothrappali in the TV hit series ‘The Big Bang Theory’.

“I’ve only been here 44 years,” says Mr Nayyar, talking exclusively to PWM over a Zoom link from his Los Angeles home. “I think that the world has gone through many cycles, many moments in history have come and gone. But this is the first time I’m experiencing three revolutions going on at the same time,” he says, speaking about parallel upheavals in AI, geopolitics and climate change.

“How does that play out? None of us can know, but what we can focus on is present moment awareness. Hopefully, when our time comes, we’ve made the world slightly better, and that’s what I’m trying to do, with every endeavour that I take on.”

Mr Nayyar’s first fintech project, IQ121, centres around an app allowing users to safely organise, store and share digital assets. Family members and their business partners can access paperwork, family photos and videos.

Essential items which can currently be stored by IQ21 include trust documentation, investment statements, property deeds, health records, security passwords, wills, videos and photos, and family birth and marriage certificates.

The idea of a “digital storehouse” came to Mr Nayyar during the Covid-19 pandemic, while organising his parents’ trip from India to the US. Struggling to gather flight numbers, passport details and hotel confirmations, he embraced the concept of maintaining all the records of an extended “global family” on a single app.

The family split their time between Mr Nayyar’s Los Angeles base, his parents’ New Delhi residence and the leafy squares of west London, close to where they lived in the 1980s.

“London has become that safety spot for us to meet in,” says Mr Nayyar, one of Hollywood’s highest paid actors, with annual earnings of more than $20m in 2015 and 2018, according to Forbes, which estimates his net worth at $45m.

Hand-picked advisers

The family’s investment portfolio is overseen by a hand-picked coterie of external experts, amalgamated with an internal family office of advisers, who essentially work together as “one team”.

“Obviously I like to diversify [assets] within that team, looking at different investments,” he says. “That’s just always been my training.”

Technology is playing an increasing part in managing these portfolios and in societal links, he believes. In one episode of ‘The Big Bang Theory’, the awkward professor he plays buys a new iPhone and develops a relationship with Siri, Apple’s robotic personal assistant. In another, on a rare library date with a fellow digital nerd, the two communicate via text message.

“We are moving 100 per cent in the direction where robotic technology will be part of our relative human existence, and both will have to work hand in hand,” he says, as society and finance enters what he enthusiastically describes as the “nerd world”, shaped by a new generation of entrepreneurs.

“I’m not saying ‘The Big Bang Theory’ was responsible for this, but when you look at the effect Silicon Valley has had, impacting money, tech and innovation, the ‘nerd world’ is also transforming culture, fashion, music and movies,” he says, with the all-conquering “frat boys and athletes” of the “old days” now ousted to the back seat.

“Suddenly, wow, that person who is worth a billion dollars is a little more attractive in their flip flops and cargo shorts and has become the bastion of what people are looking up to, as opposed to looking down on in the past,” he says.

India’s dreamers

Mr Nayyar’s family in India are also heavily involved in the tech ecosystem. “My brother is in a similar business of finance and tech, and there is something nice about investing back in the infrastructure of the place you grew up in,” he says. “India is a country of dreamers, where we feel like anything is possible. So to be a part of a movement like that is really exciting. And I think that there’s going to be a lot of incredible stuff coming out of India in the future.”

This marks a reversal of the 1970s, 80s and 90s, when “a lot of our families moved to America or England, to find opportunities because the ceiling was very low at the time,” he says. “When we start looking at the ceiling or the future of where India is going, it’s almost like we’re blowing it through the roof,” he says. “The sky is infinite for us. And now you’re seeing India reaping the benefits of it.”

My brother is in a similar business of finance and tech, and there is something nice about investing back in the infrastructure of the place you grew up in

The next stage of his plan is to expand the app to include other features, including the narratives of a family legacy which can be automatically uploaded into a family tree. “Hopefully that will be passed down from generation to generation to generation,” he says.

The notion of legacy is central to Mr Nayyar’s work. He talks about how he and his wife Neha Kapur, an Indian model and beauty pageant winner, have funded scholarships for young students studying creative arts at the University of Portland in the US, to make sure that the next generation of actors “don’t have hundreds of thousands of dollars of debt”.

Similarly, he wants to back fintech developments that are in no way restricted to a financial elite. The future, he believes, is in democratised, mass market services. “They will really get sort of amalgamised into the way in which we live this relative human experience.”